Shared ownership staircasing

Staircasing is the term used to describe buying more shares in your home. Buying more shares in your home means paying less rent – sounds good doesn’t it? By staircasing you will have bought more shares of your home, reduce your rent and move forward on a journey to potentially owning your home – if that is what you wish to do.

What is shared ownership staircasing?

The easiest way to remember what shared ownership staircasing is, is to think of the property ladder. Staircasing helps you to move up the property ladder by slowly increasing the shares that you have bought in your home. Staircasing allows you to purchase a greater number of shares in your property over time – if you want to.

The price of the new shares will depend directly on the value of your shared ownership home at that time – this will need to be determined by a member of the Royal Institute of Chartered Surveyors (RICS) if you are purchasing shares of 5% or more. You can learn more about how shared ownership works here.

The Aster staircasing process

- We start by working out the current value of your home. As mentioned, currently this is performed by a member of RICS. Don’t worry, instructing a valuation doesn’t mean you have to commit to buying more shares, but you will still need to pay for the valuation. (If the terms of your lease allows you to purchase additional 1% shares, the value will be based on the house price index (HPI) and a RICS valuation will not be required.)

- We will work out how much you need to buy the shares you want and send you a report.

- You then need to advise us, in writing, how many shares you want to buy.

- Then, we’ll need your solicitor’s contact details and payment of our administration fee* (fee details can be found in our FAQs below) - this can be paid via bank transfer, online or over the phone.

- When we have this, we will instruct our solicitor and yours of your intention to buy shares.

- We work with the solicitors closely until this has completed and are available if you have any questions or need any support.

*Staircasing administration fee of £150 (plus VAT) is applicable when purchasing shares of 5% or more, however if your lease allows you to buy shares of 1%, the administration fee and process above will not apply. Please speak to a member of our team for more information

What are the pros and cons of staircasing?

The main benefit of staircasing is that you have the opportunity to buy more shares in your home, in most cases eventually having the chance to own the property outright if that is what you want. Even better, it means you pay less rent and who doesn’t want that? Staircasing is also a great way for you to practically budget and gain traction on the property ladder.

The only cons of staircasing may occur if your specific property has any limitations on ownership – for example in rare instances some homes can only be owned up to 80% however the friendly team at Aster Sales can advise where this may be the case and you will be made aware when purchasing your home.

FAQ’s

I’ve made home improvements. Will this affect buying more shares?

We always encourage you to advise us of any improvements you wish to make to your home whilst you are still a shared owner and remind the valuer of these when they visit your home. This way they can assess whether this has added any value to the property. This amount can then be taken off the full value before we work out how much you would pay for additional shares.

What will it cost to buy more shares?

The following charges will be incurred when buying more shares, however if your lease allows you to buy shares of 1% (e.g. under the new shared ownership model), the administration fee will not apply. Please speak to a member of our team for more information regarding this:

- Administration fee - £150 (plus VAT)

- Surveyor valuation fee – around £300 (plus VAT)

- Solicitors fees

- Stamp Duty – if your new total share is over 80%.

Will I need another deposit?

Some lenders may need you to pay a further deposit, however in many cases you can avoid this if you re-mortgage to a new lender. We can put you in touch with mortgage advisers to assist with any queries.

Do I still have to pay rent and service charge after I have staircased?

If you have bought 100% of the shares in your home, you own the property and do not have to pay rent but if you still have a service charge you will have to pay this. If you don’t own 100% you still need to pay us rent and service charge but of course the rent will reduce based on the shares you now own.

What if my house has gone up or down in value?

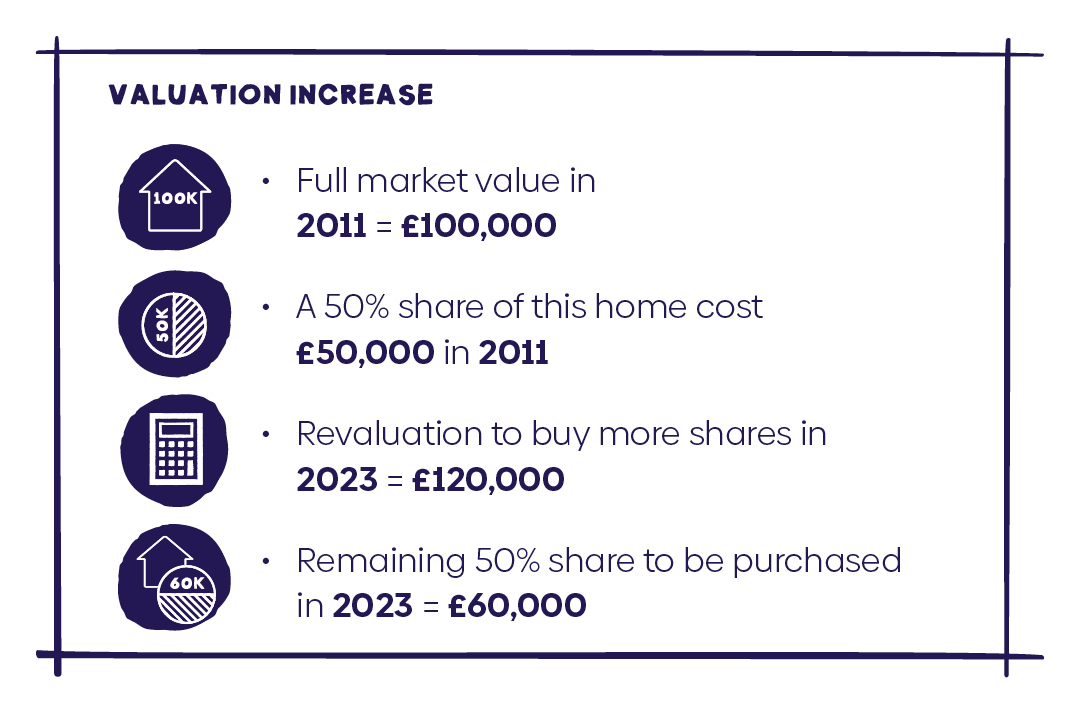

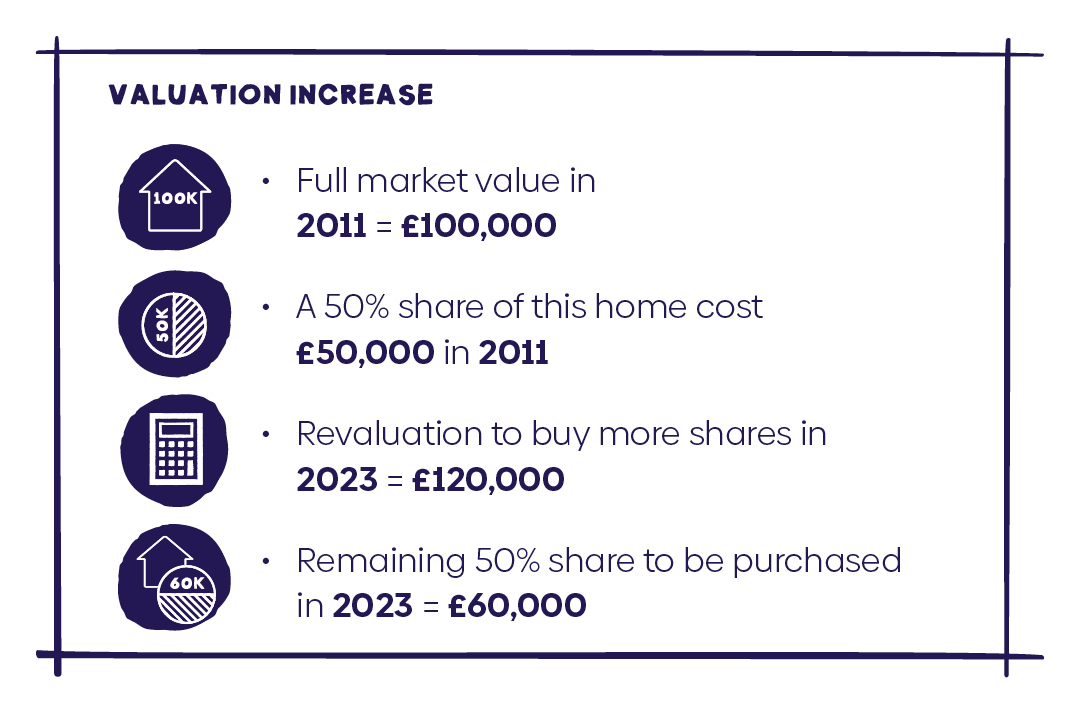

The shares you buy are based on the market value of your property at the time of the survey irrespective of whether it has increased or decreased in value. For example:

What if I don’t agree with the valuation?

If you don’t agree with the valuation you need to put it in writing. Then we generally will ask for examples of around 3 or more homes in your area that have sold in the last 3 months. We send these to the valuer for further assessment.

If the valuer stands by their assessment or you still don’t agree you have the right to invest in further valuation and then the differences can be discussed, and a decision reached. You must use a RICS accredited surveyor.

Can I arrange my own valuation?

You can choose a valuer of your own, but they must be a registered member of RICS and we will need a copy of the full report – to include the entire freehold interest of the property.

We have a fantastic range of shared ownership properties and developments for you to browse, get on the property ladder today!

01305 735480