What is Affordable Housing?

To put it simply, affordable housing are homes aimed to be priced within reach of people. This can be social rented housing, rent at below market price, and intermediate housing. Shared ownership also falls into the bracket of affordable housing and that’s where Aster comes in. Aster specialises in providing shared ownership properties that enable people to take their first step onto the property ladder.

Why is affordable housing important?

Affordable housing is much more than just four walls and a roof. It's a symbol of security, safety, and freedom. It's no secret that the UK housing market has become increasingly difficult to navigate in recent years. With house prices soaring and rents rising, it can be tough for many to find a place to call home.

For many households, the cost of housing is a heavy burden. In this instance, affordable housing can be an incredible asset to communities and the economy. Allowing people to live where they work significantly reduces commuting times and housing costs too – a win-win situation for individuals and businesses!

The need for affordable homes

The need for affordable homes and affordable rent options has become increasingly urgent in recent years as house prices continue to rise faster than wages. This has created a growing divide between those who can afford a home and those who cannot. In some areas of the country, the average house price is more than ten times the average annual salary,(the Intermediary) making it almost impossible for many people to buy a home.

As a result, the demand for affordable options continues to grow. This highlights the need for continued investment in affordable housing projects and the development of new, innovative solutions to private market rent to address the housing affordability crisis.

One of the most important aspects of affordable homes is affordable rent. This refers to homes rented out at below-market rates, providing tenants with a more affordable housing option. Affordable rent homes are typically owned and managed by housing associations or local authorities, who work to keep affordable rents and ensure that they are accessible to those on lower incomes.

How is affordable housing provided?

Finding an affordable place to live can be tricky, but there are more options than you might think!

Affordable rent and intermediate housing are also available, plus plenty of opportunities to buy your dream home through home-buying schemes. Shared ownership supports the affordable housing supply by allowing buyers to purchase a share of a property and pay rent on the remaining share, making it more achievable to get on the property ladder.

Local authorities, housing associations, and even private sector developers offer these amazing housing options - making it more achievable to find your dream home.

At Aster we specialise in providing shared ownership properties and our homes are available to people who are unable to afford to buy a home outright, providing an alternative way to get on the property ladder.

Affordable housing options

If you are looking for affordable housing options, contact the local authority or housing association in your area. They can provide you with information about the availability of affordable housing options, including shared-ownership homes. For all information surrounding shared ownership providers in your area, click here for the GOV website.

Shared Ownership Properties

Here are some key steps in the shared ownership home-buying process:

- Find a shared ownership property: There are several different ways to find shared ownership properties, including searching online property portals, contacting housing associations directly, and attending property exhibitions. It is our goal at Aster to make your journey informed and fully supported. Get in touch with our team today!

- Check your eligibility: Before applying for a shared ownership property, you must check whether you meet the eligibility criteria. These criteria can vary depending on the property and the housing association managing it. Shared ownership can work for first-time home buyers or those who are upsizing or downsizing. If you already own a home; your current home will need to be sold. You’ll also have a household income of less than £80,000 per year (or £90,000 per year if you live in London) and be able to secure a mortgage for your share of the property.

- Arrange a mortgage: Once you have found a shared ownership property you are interested in, you will need to arrange a mortgage to cover your share. You can do this by directly approaching a mortgage lender or working with a mortgage broker. In some instances, depending on your circumstances you may be able to buy your share outright, but speak to our team and they will be able to advise further on this. We are teamed with The Mortgage People, a trusted group of mortgage advisors specialising in shared ownership mortgages. Our guide: shared ownership mortgages explained can give you more insight into how these mortgages work.

- Starting the buying purchase: Once your mortgage is secured and the shared ownership application approved, you're ready to complete the purchase which may involve the following:

Conveyancing

A conveyancer or solicitor handles the legal side of the purchase. They will:

Carry out searches on the property

Check legal titles and lease

Raise enquiries regarding the property you are buying

Transfer funds and complete contracts

Liaise with all parties to facilitate exchange and completion

Surveys

A surveyor will inspect the property thoroughly on your behalf (at a cost). Your mortgage lender will require a valuation survey.

Exchange of Contracts

This legally commits you and the seller to the purchase. Your deposit will be transferred at this point by your solicitor. The completion date is set.

Completion Day

On the completion day, your solicitor transfers the remaining funds. Once received, the Housing Association releases the keys, and you can move in!

There are many different aspects to the buying process, but the friendly team at Aster will be able to guide you every step of the way so you know what to expect. Once this process is complete, your purchase of the share of the home will be finalised.

- Pay rent and service charges: In addition to paying your mortgage, you will also need to pay rent on the share of the property you haven’t purchased and service charges each month. These charges vary depending on the property but typically include building maintenance and insurance.

It is important to note that buying a home can seem quite complex, and seeking professional advice and guidance is advisable throughout the process. Within Aster, the sales team are on hand to navigate you through the shared ownership home-buying process.

Our property buying guide can give you more insight into what to expect when purchasing a home.

Why Aster?

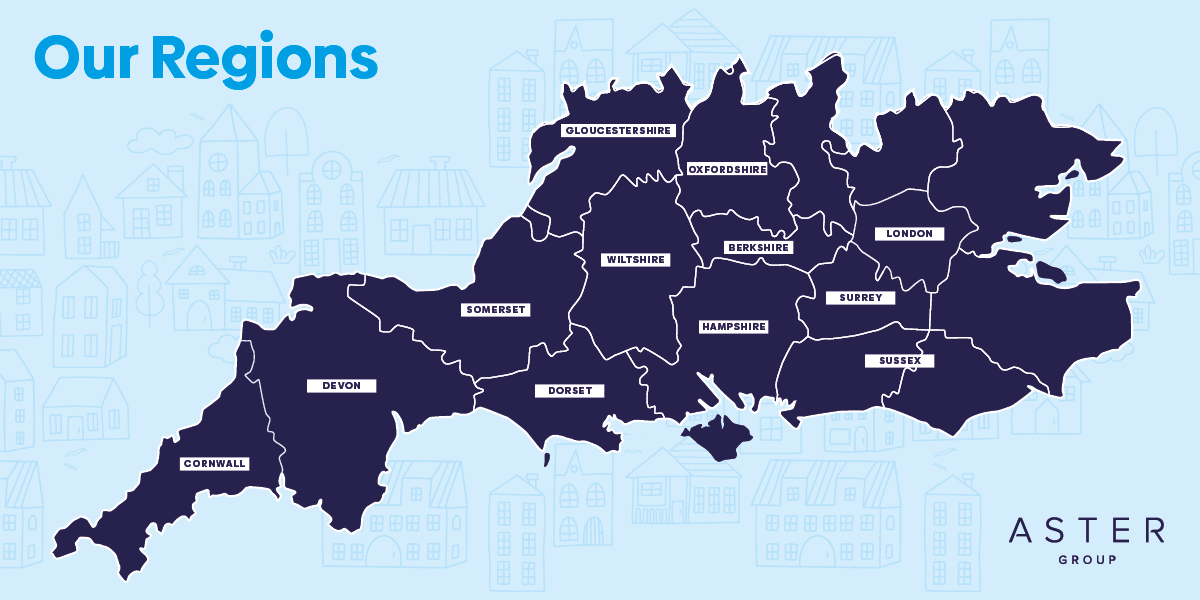

If you are interested in shared ownership properties, Aster is a housing association that specialises in providing affordable housing solutions. We have a wide range of properties in different locations across the South of England, including London, offering one- and two-bedroom apartments and one-, two-, three-, and four-bedroom houses.

In addition to shared ownership properties, Aster provides affordable rented housing and other affordable housing solutions. They work closely with local authorities and housing associations to identify areas of housing need and provide homes that meet the needs of their customers. You can find more information about affordable rental homes here.

Summary

Affordable housing refers to homes that are priced to be within reach for people who are unable to rent privately or buy a home outright on the open market. Affordable housing options include social rented housing, affordable rented housing, and options like shared ownership.

These homes are provided by housing associations, local authorities and developers and help make suitable housing accessible to those unable to purchase at full market rates.

Frequently Asked Questions (FAQ)

What is affordable housing?

Affordable housing refers to homes available to rent or buy, making them accessible to people unable to rent privately or buy on the open market.

These homes are often provided by housing associations, local authorities or private developers and can take various forms, including social rented housing, affordable rented housing and shared ownership properties.

Who is eligible for affordable housing?

Eligibility for affordable housing varies depending on the scheme and the property's location. Generally, for shared ownership, you need a household income of less than £80,000 (or £90,000 in London) and cannot afford to buy a suitable home on the open market.

There may also be other eligibility criteria, such as having a local connection to the area.Click here to view the full eligibility requirements.

What is social rented housing?

Social-rented housing is a type of affordable housing that local authorities or housing associations provide. Rents for socially rented housing are typically lower than market rents, and tenants have greater security of tenure than those in the privately rented sector.

What is affordable rented housing?

Affordable rented housing is affordable housing provided by local authorities or housing associations. Rents for affordable rented housing are higher than the social rent but usually lower than market rents.

What is shared ownership?

Shared ownership is affordable housing in which you buy a share of a property (usually between 25% and 75%) and pay rent on the remaining share to a housing association or other provider. This enables you to get on the property ladder with a smaller deposit and mortgage, making buying a home more accessible to those unable to buy on the open market.

Find out more about how shared ownership works in our guide here.

How do I apply for shared ownership?

You can usually apply for shared ownership through a housing association or developer offering shared ownership properties in your area. They will assess your eligibility and guide you through the process, which can involve financial checks and a mortgage application. You can also contact your local authority or housing association to learn more about the availability of shared ownership properties in your area.

For even more information, take a look at more of our shared ownership FAQs.

.png)