Create an Aster account for alerts on homes right for you. You can update and adjust your alerts and ‘favourites’ through your own account as you go and you’ll be the first to get information on homes when they become available.

It’s an ownership thing.

Associated costs when buying a home

When it comes to buying your dream home – it’s not just about saving for a deposit. The costs of buying a house include much more. Whilst you may be aware of the bigger expenses, there may be some additional costs you haven’t considered. For example, have you thought about the legal fees? Stamp duty? Or the actual cost to move? If not – don’t worry! Our helpful guide will talk you through all costs involved in buying a house. Once you’re clued up – you’ll be one step closer to getting the keys to the house you’ve fallen in love with.

What are the costs involved in buying a house?

Generally, the more money you put down for a deposit, the better the deal will be on the interest rate for your mortgage. There are also several other costs you’ll need to cover too, and it’s always a good idea to keep a little on the side in case of an emergency.

Below are the various types of associated costs you need to look out for when it comes to buying a house. Make sure to keep in mind that these costs can vary depending on your individual circumstance and the price of your dream home.

Mortgage fees

Mortgages are a lot more than monthly repayments and you need to consider these “extras” into your calculations. For example, these include expenses such as:

Booking fee

Some lenders charge this to secure a fixed-rate, tracker or discount deal and the amount typically ranges between £100 to £200. Generally, this fee is paid as soon as you submit your application and it’s non-refundable. This still applies even if your property purchase falls through.

Arrangement fee

Also known as a mortgage product fee, this is a major part of the true cost of a mortgage along with the interest rate. The amount also varies depending on the lender and the mortgage deal. It can range from anything between zilch to several thousands of pounds.

Beware though! Often the lowest interest rates come with the highest fees – and we know such tactics definitely catch the eye. To beat these tricks, you can work out the true value of a loan by comparing the fee, interest rate and length of the deal. We also advise paying for such fees upfront instead of stacking them onto your mortgage. After all, you don’t want to be paying interest on them for the lifespan of your mortgage!

Valuation fees

If you’re arranging a mortgage, the lender can also charge a valuation fee in some instances to check whether the home you’ve got your heart set on is actually worth it. Remember – the charge can be different to what you’ve offered as well.

The purpose of a valuation fee is for the lender’s own security. Though, if you’re one of the lucky ones – not all lenders will charge for a valuation fee as they can sometimes be included in your mortgage deal. Fingers crossed!

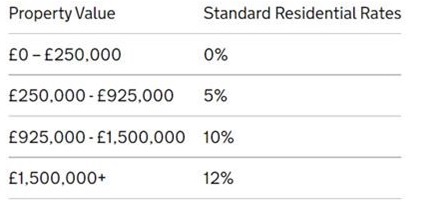

Stamp duty

When it comes to buying a property – there are of course costs which require you to pay tax to the government (stamp duty). If you’re a first timer, you won’t need to pay it on homes costing up to £425,000, and you’ll pay a discounted rate on homes up to £625,000. A win win situation, right?

If you want to work out how much stamp duty you’ll pay on your new abode – we’ve made a table below with all the information you need:

Interested in knowing how much you would pay on a Shared Ownership home? Click here to calculate how much stamp duty you would pay. However, if you would like advice which takes into consideration your own personal circumstances, we recommend seeking independent legal advice.

Conveyancing fee

When there’s a house involved – there’s always legalities too of course. Normally, you'll need to pay a solicitor or licensed conveyancer to cover the cost of all the chunky paperwork that comes with buying a home. This includes conveyancing (dealing with the transfer of ownership), making sure paperwork is in order and checking for anything that could cause any surprises further down the line.

Now you’re probably wondering how much are legal fees when buying a house? Well, the cost of conveyancing fees depends on several factors. These include the value of the property you’re buying and the local searches you’ve done. Typically, conveyancing costs can range from £850 to £1500, plus £250 to £450 for disbursements (local searches etc) – again this is subjective. Solicitor fees for buying a house tend to be a little more expensive than conveyancing fees. They can be anything from £1,000 to £1,500. However, this is again subjective, and the final cost will depend on how much your property costs. Make sure you’re prepared – you may also have to pay the solicitor at a number of points during the purchasing process, as they incur costs on your behalf.

Land registry fee

There’s also land registry fees to consider in the costs involved in buying a house. What is land registry fee we hear you ask? Well, luckily for you, compared to the other associated costs of buying a property, this one doesn’t require you to dig super deep into your pockets. The Land Registry needs to register homes under their owners' name. This means when you bag your dream home from someone else, the Land Registry charges to transfer their register entry into your name. Trust us – it’s a small price to pay to have your pride and joy in your name!

This cost of the land registry fee depends on how much your home is worth. Remember the disbursements we mentioned before which solicitors charge for? This is one of them!

Moving costs

Don’t forget to factor in the cost of moving house too! The fees will differ depending on the amount of furniture and belongings you own, how far you're moving and whether you go for extras e.g., professional packing. There are a variety of different options available from hiring a van to using a removals company. These can start from as little as £100 for small local moves but can easily increase to £1,000 if you’re packing up your treasures to the other side of the country.

Rent (for shared ownership)

We know what you’re thinking – where does rent play a part in the associated costs of buying a house? Buying a house these days is hard and there are schemes out there to ease the strain a little and get you flying high on the property ladder. Welcome shared ownership into your lives! Shared ownership is a scheme which allows you to buy a share of the home you’ve got your eyes set on and then pay rent on the rest. Sounds too good to be true right? Thankfully for you – it’s the real deal!

With shared ownership you’ll go through a similar process as with a mortgage lender. However, when you're buying a property through this scheme, two costs in particular will need to be considered:

- The rent you'll pay on the share of the property that you don’t own.

- The service charges you'll pay due to shared ownership homes being sold on a leasehold basis.

The Aster process

What better way to bag your dream home than with the Aster way? Shared ownership will get you on the property ladder with no compromises on the home you want. Whilst the other costs we’ve discussed above can still be involved, on the bright side, you can kiss goodbye to those hefty deposits!

Best of all – with staircasing you can buy more of your dream home in the future depending on your circumstance and preferences. For example, typically you can buy a share between 40% to 75% on your initial purchase – sometimes you can even go as low as 10% depending on the terms of your lease. From there you can continue to buy more shares as and when it suits you.

Looking for somewhere to call your own? Head over to our developments location page and see if anything catches your eye. Go on – you know you want to! Or if you’re a newbie to all this and you still need more guidance on bagging your dream home – take a look at our handy property buying guide to get clued up on the process.

The bottom line is that the costs of buying a home can add up quickly which means being prepared is key. Now you can embark on this exciting journey better informed about what to factor into your budget. And don’t forget – if there’s anything that’ll make the costs that come with buying a house seem a little less exhaustive – shared ownership could be the one.